tax service fees fha loans

The tax service fee is typically paid by the buyer to the lender at the time the home is purchased. Fast Tax Refund Loan In a matter of.

Wells Fargo Home Mortgage Review Nextadvisor With Time

FHA loans often involve a tax service fee for the management of the escrow impound account.

. The amount varies based on location and lender guidelines. The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage website. Appraisal - if ordered in Veterans Name.

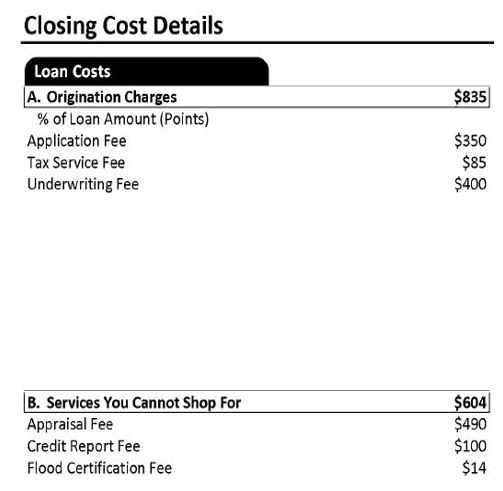

Settlement Fees Required to Close The Deal. For example FHA rules allow the lender to collect an origination fee. Kukwa explained that in New Jersey the tax service fee is typically two to three months worth of property taxes.

For example FHA rules allow the lender to collect an origination fee. What is a tax service fee FHA. VA and FHA loans.

The same letter prohibited loan origination fees of more than 1 percent. Tax Service Fee 50 This fee is paid to research the existing property taxes. FHA Loan VA Loan HECM Reverse Mortgage Jumbo Loan FannieFreddie and Conventional Loan Limits for Orange New Jersey.

What is a tax service fee FHA. Loan for Tax Refund Lenders Available Loan for tax refund - Get your refund much faster and get up to 1000 all without leaving your home or office. Tax Service Fee 50 This fee is paid to.

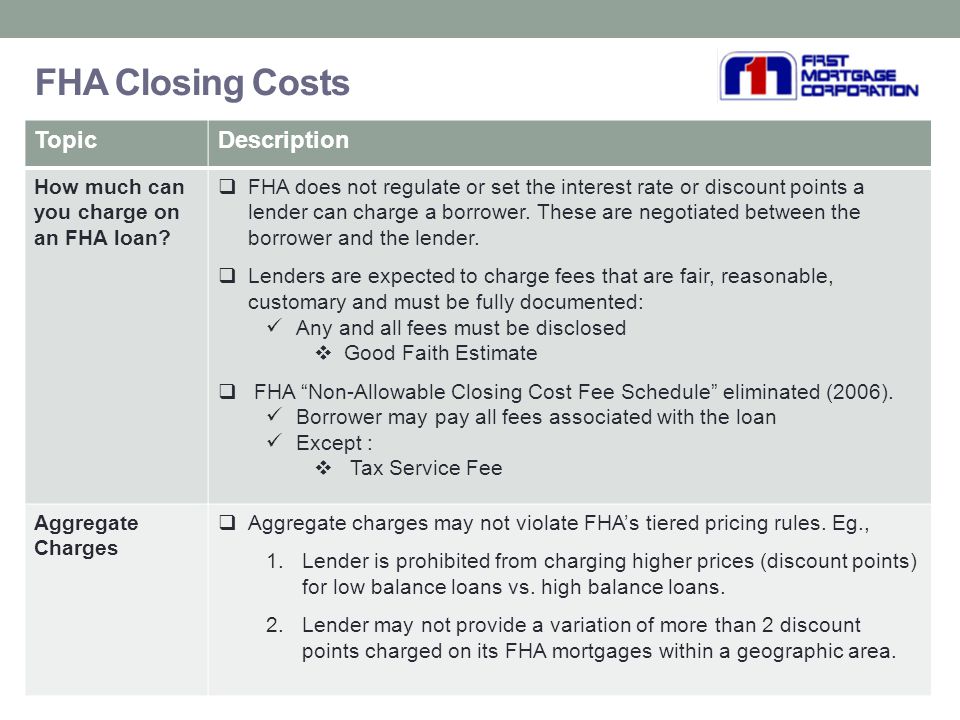

The one percent fee cap was. For loans through the end of 2009 the fee was limited to one percent. A tax service fee directly benefits the loan servicing company or the.

2022 Loan limits in Orange New Jersey. The one percent fee cap was eliminated. If you apply for a tax refund loan prior to filing your taxes we highly recommend you file your taxes quickly to avoid the need to file for a loan extension.

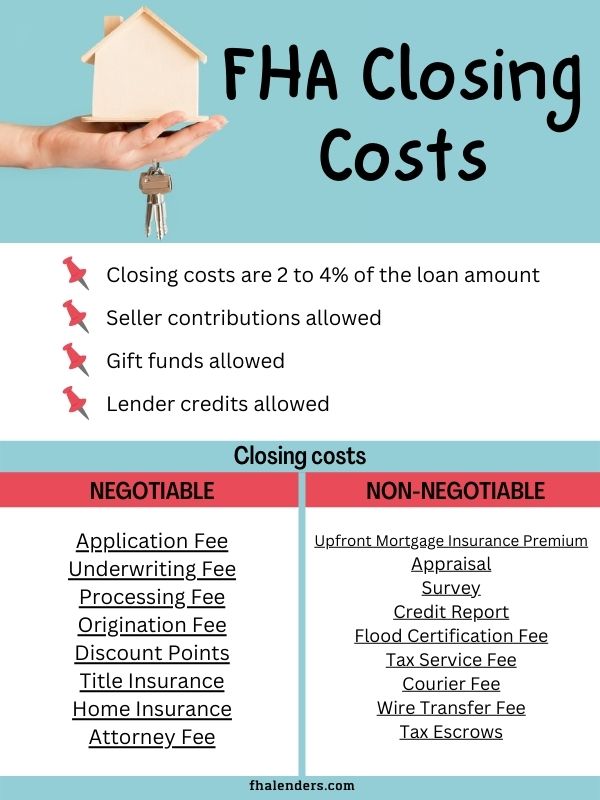

A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay. Mortgagee Letter 06-04 virtually eliminated the prohibited closing costs with the exception of the tax service fee. Document Draw Fee if required for Buyer Notary Fee.

Tax Service Fee 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been. FHA lenders will finance up to 965 percent of the purchase price for a property August 12 2013 Recently many potential home buyers have been seeking FHA loans. The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage.

Can you charge a tax service fee on an FHA loan. Title Insurance - ALTA. For loans through the end of 2009 the origination fee was limited to one percent.

Understanding Closing Costs Sirva Mortgage

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional What S The Difference

How To Reduce Closing Costs Smartasset Com

Fha Closing Costs Complete List And Estimate Fha Lenders

2022 Can You Deduct Fha Closing Costs On Your Taxes Fha Co

Va Loan Funding Fee Closing Cost Calculator

What Costs Does The Seller Pay For An Fha Loan

How To Use Fha Loan To Buy A Rental Property

What Is An Fha Home Loan Everything To Know About Qualifying For An Fha Loan Bob Vila

Everything You Need To Know About Fha Loan Closing Costs

Fha Closing Costs Complete List And Estimate Fha Lenders

What Costs Does The Seller Pay For An Fha Loan

:max_bytes(150000):strip_icc()/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

First Mortgage Corporation Ppt Download

Tax Service Fees For Va Fha Loans Hud Handbook

:max_bytes(150000):strip_icc()/GettyImages-827951038-ae4d10b87eb24118bcb5bdc3fe3ecc4c.jpg)